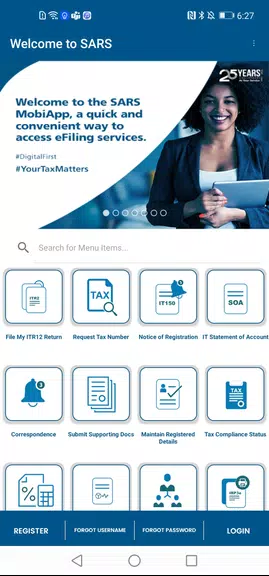

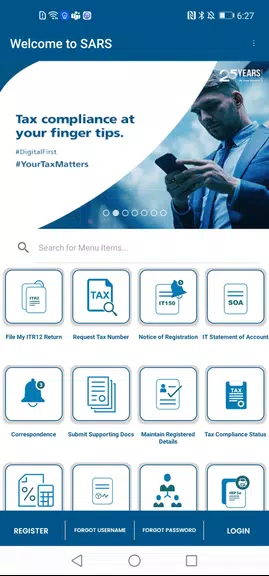

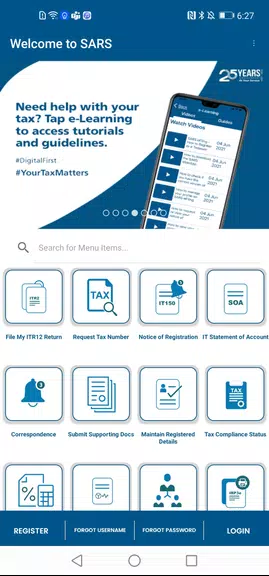

The SARS Mobile eFiling App revolutionizes tax filing for South Africans, offering a simple and convenient way to prepare and submit Income Tax Returns from anywhere. This advanced app lets you retrieve your annual returns, save and edit drafts directly on your device, utilize the tax calculator for estimated outcomes, and check your return status after submission. It simplifies and secures the eFiling experience, enabling you to manage tax obligations anytime, wherever you are.

Features of SARS Mobile eFiling:

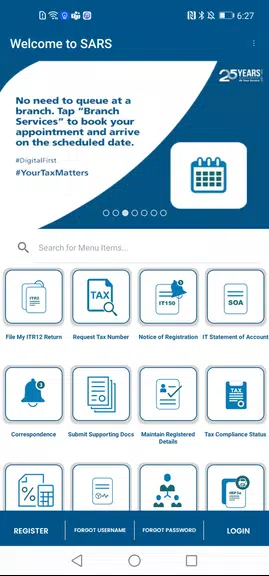

- Convenience: Easily complete and submit your yearly Income Tax Returns using your smartphone, tablet, or iPad for a fast, uncomplicated process.

- Accessibility: Manage your taxes with increased flexibility, as the app is available around the clock no matter your location.

- Security: All submitted data is protected through encryption, ensuring your peace of mind when filing online.

- Tax calculator: The integrated calculator provides an estimate of your assessment, helping you budget and prepare accordingly.

FAQs:

- Is the SARS Mobile eFiling app secure?

Yes, the app uses encryption to keep all your information safe and secure.

- Can I access my past tax returns through the app?

Yes, you can view summaries of your Notice of Assessment (ITA34) and Statement of Account (ITSA) in the app.

- Can I use the app to file my business taxes as well?

Currently, the app supports only individual taxpayers for personal Income Tax Returns.

Conclusion:

Boasting convenience, accessibility, and strong security, the SARS Mobile eFiling app is essential for anyone aiming to simplify tax filing. Whether you regularly eFile or are just starting, this app makes handling taxes simpler than ever. Download it today and manage your taxes seamlessly on the go.